Optimization platform

Discover:

BESS markets

Ancillary services

Imbalance optimization

BESS use cases

Grid-scale

Co-location

Behind-the-meter

BESS revenues

Tolling

Fully merchant

Floor with and without cap

BESS onboarding

Go-live preparations

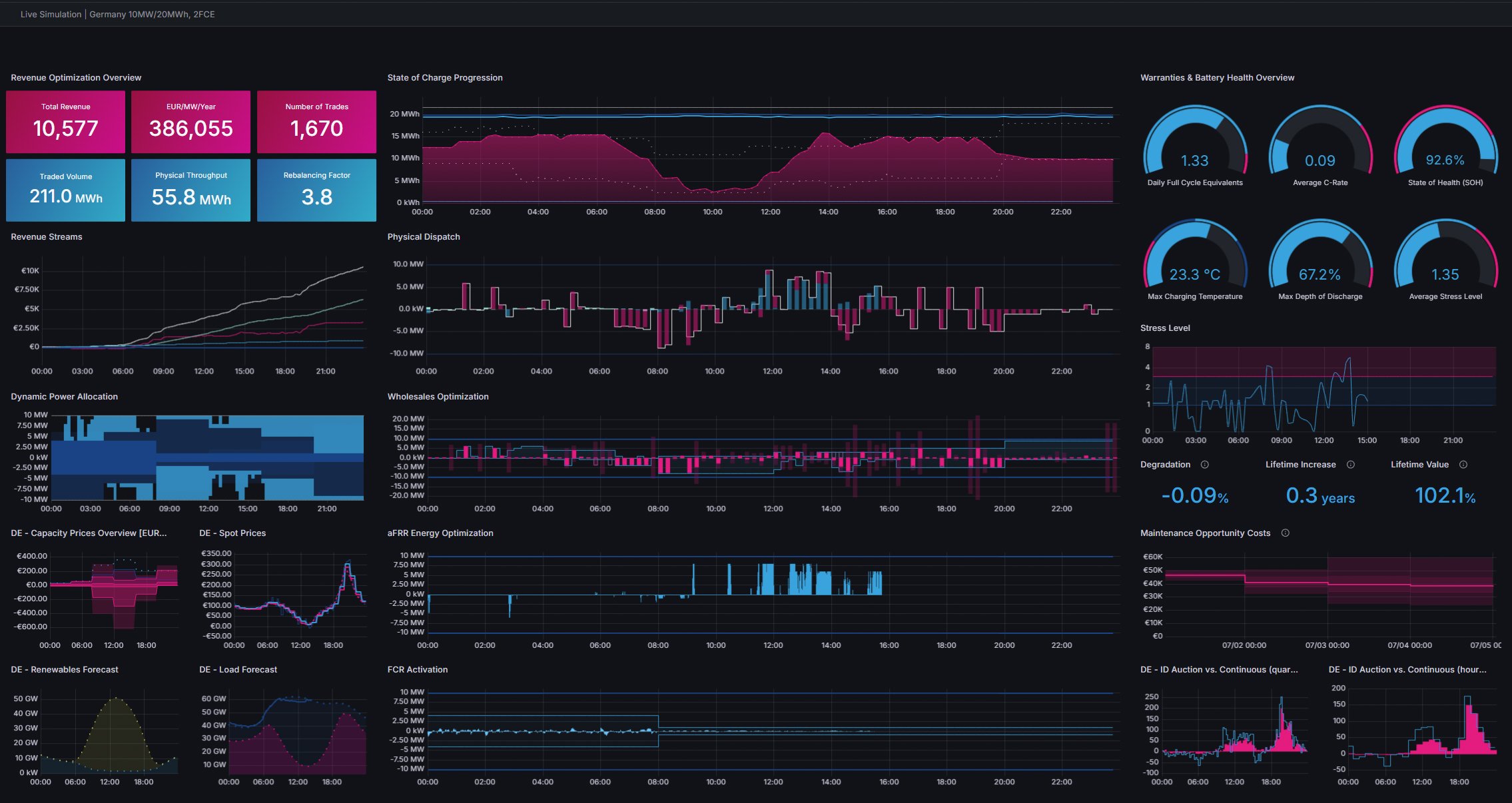

Dashboard

Customer portal

BESS optimizer setting new revenue standards in Europe

We maximize the revenues, efficiency, and lifespan of battery energy storage systems with data-based optimization in the power markets. Your asset achieves peak profitability with minimum degradation while supporting the grid and renewable integration.

management

in optimization

increase

Portfolio performance

grid-scale BESS Germany

Please note: 2-hour portfolio performance includes durations from 1.51-3.5 hours.

BESS service

Feasibility

study

We ensure the bankability of your BESS use case with expert market knowledge, high-quality backtests, and certified portfolio performance.

Permits and regulatory approval

We supply data support for TSO requests and play an active role in defining the regulatory market frame.

Financing and partnerships

Our integrated EPC ecosystem is based on mutual knowledge sharing. This includes an introduction to financial parties (banks and investors), tailored revenue models (fully merchant, tolling, floor, hybrid), and market-approved terms and conditions.

Design and procurement

We consider warranty terms and asset-specific restrictions in the optimization and use simulation dashboards and dedicated backtests to configure the system around your requirements in the pre-trading phase.

Testing and commissioning

We ensure seamless onboarding, handle of the prequalification process, and conduct all required testing.

Operation and maintenance

You have 24/7 access to our trading dashboard, and we provide regular updates to keep you informed. With degradation-informed optimization and optimized maintenance planning, we achieve superior BESS performance and revenues.

Your interface, our technology

access to a live optimization dashboard.

Alicja Kowalewska-Montfort

Principal Energy Storage

Gore Street Capital

22 MW / 29 MWh battery in Cremzow, Germany.

The challenge:

Expanding to Germany as a British investor.

Michael Strebl

CEO

Wien Energie

4-hour battery co-located with solar in Austria.

The challenge:

Maximizing wholesale revenues from a battery with PV-specific restrictions.

Stella Zacharia

CEO

Optimus Energy

Five battery systems with a total capacity of 270 MW in Athens, Greece.

The challenge:

Accessing BESS optimization in a country that doesn’t offer such services and faces energy curtailments due to an abundance of solar and a lack of storage.

Jose Abel Cabezas Jiménez

Head of Innovation

Uniper

6 MW / 7.52 MWh in Aachen, Germany

The challenge:

Assessing the monetary potential of a grid-scale battery during the infancy of BESS optimization, and moving the asset from a simulation to a real trading environment.

Frank Günther

CEO

VBB

15 MW battery with 1-hour duration in Bordesholm, Germany.

The challenge:

Future-proofing battery revenues and securing long-term profitability for a utility use case.

Stefan Englberger

Head of Commercial

ECO STOR

103.5 MW / 238.5 MWh in Bollingstedt, Germany.

The challenge:

Securing financing with reliable revenue planning and effective market participation for one of Germany’s biggest battery projects.

Martin Poscholann Christensen

Investment Manager Energy Storage

Obton

137.5 MW / 306 MWh in Alfeld, Germany.

The challenge:

Simultaneous participation in all relevant short-term markets with dynamic adjustments based on grid needs and price signals to ensure a stable electricity supply, minimized energy costs, and profitable asset management for one of Germany’s largest BESS projects.

BESS markets

Where we optimize your battery.

Wholesales

In the wholesale market, we ensure consistent revenue diversification and real-time value capture with intraday continuous trading.

Ancillary services

By participating in ancillary services, we help grid operators balance the system in the day-ahead and intraday markets. Batteries can profitably utilize the primary (FCR) and secondary reserves (aFRR energy and aFRR capacity).

Imbalance optimization

In countries where imbalance chasing is allowed, it’s included in our cross-market optimization strategy.

BESS use cases

Grid-scale batteries deliver cost-efficient, fast, and decentralized flexibility. We maximize revenues and minimize the costs of your existing or planned grid-scale asset(s) by:

- evaluating the revenue potential and most profitable optimization strategy for specific system layouts.

- executing the most optimal utilization across all markets.

- taking into account all warranty terms and cell-specific degradation aspects.

Guy Holding

Head of Sales

Ramona Wendtner

Senior Business Development Expert

Alberto Alberti

Head of Business Development

Co-located batteries are most commonly paired with renewables to share grid access with solar and wind generation. We make co-located BESS profitable by:

- assessing revenue potential, including shared grid access parameters and generation profiles of co-located assets.

- optimizing performance and delivering replacement volumes to ensure PPA conformity for renewable generation.

- executing earning power with all technical and commercial constraints in mind.

Guy Holding

Head of Sales

Ramona Wendtner

Senior Business Development Expert

Alberto Alberti

Head of Business Development

Guy Holding

Head of Sales

Ramona Wendtner

Senior Business Development Expert

Alberto Alberti

Head of Business Development

Guy Holding

Head of Sales

Ramona Wendtner

Senior Business Development Expert

Alberto Alberti

Head of Business Development

BESS revenue models

BESS onboarding

Project review

In a first call, we’ll discuss your use case, questions, and recommended optimization strategy. We’ll prepare NDAs and contracts for alignment.

Requirements

We ensure your project meets all commercial and technical requirements and set up our system according to your asset specifications.

Go-live

We exchange regular project updates. Once your battery is live, you can follow trading activities and asset data in real-time via the dashboard in your customer portal.

What are the 14 most important steps when financing, building, connecting, and monetizing a battery asset?

FAQs

Burning BESS and trading questions, answered.

To maximize battery revenues, you need to have access to as many markets as possible, specifically wholesales (intraday continuous), ancillary services (FCR, aFRR energy, aFRR capacity), and imbalance markets (in some countries). The optimal allocation of capacity must be decided on a daily basis and can even go down to a block-by-block level.

As all markets share the same capacity and SoC range, they interact with each other dynamically. For instance, FCR has a fixed MW/MWh relation that leaves the unused SoC range for other markets. By accessing all available markets, you diversify revenues and minimize risk.

Yes, our optimization models respect all warranty terms and technical constraints, such as throughput, full cycle equivalents, temperature limits, and changing round-trip efficiencies to avoid penalties, faster degradation, and the potential loss of warranties. But our service goes further than that: Our optimization isn’t just warranty-safe — it also reduces degradation so your battery can live longer and generate more revenue.

Thermal restrictions are typically rigorous components of the warranty terms. Improper management of thermal profiles violates warranty terms and can lead to unexpected container shutdowns. We use thermal models to ensure compliance. In wholesale arbitrage, for example, these help predict the impact of your dispatch on asset temperature.

Dimensioning typically depends on your outlook, as longer durations are associated with higher CAPEX. When FCR was the only source of revenue, mostly one-hour systems were built for cost-efficiency reasons. If you want to leverage multiple markets for commercial optimization, 1.5- and 2-hour systems currently give you the best return on your investment.

For behind-the-meter assets, use cases like own consumption and peak shaving must be considered when sizing the battery. Learn more about BESS dimensions and longer-duration storage.

5 MW and up.

- Wholesale market (intraday continuous)

- Ancillary services (FCR, aFRR energy, aFRR capacity)

- Imbalance optimization

Our core market is Europe, but we are always scouting promising new locations. Check our map for more details.

We try to minimize the time spent on technical alignment by conducting it in parallel with commercial discussions. This allows us to go live with our customers the day the contract is signed.

Yes, we serve customers with and without market access.

Yes. As an active market participant, we have direct market access.

Yes. Learn more about EPEX SPOT’s PCT (Professional Certified Trader) program here. We developed this idea together with the exchange and became the first PCT to offer on-behalf optimization services.

We don’t penalize customers for unfortunate, unforeseeable circumstances. Our solution is problem-proof. Once your asset encounters unplanned downtime, you can update the amount of spare flexibility, and the algorithm starts trading back positions immediately.

Yes, our technical customer support is available 24/7.

Related articles

BESS in Poland

This article explores commercial dynamics, grid conditions, regulations, and revenue/cost factors for battery storage in the high-interest market Poland.

BESS in Spain

With an impressive project pipeline and strong regulatory support for battery development, Spain is on track to become a leading BESS market by 2030.

Securing BESS financing with a bankable optimizer

Bankable forecasts enable BESS financing, but they're only one part of the equation. A viable business case also hinges on real-world optimization results.

Monthly BESS news straight to your inbox

Join thousands of other industry experts and keep up to date with the latest energy news, market innovations, and tech insights!